INCOME TAX SECTION 80DDB FORM FREE DOWNLOAD

Thus, the assessee can then claim only an amount of Rs. Deductions under this chapter cannot be claimed against long term capital gains, short term capital gains covered under section A, winnings from horse races or lotteries or such other income covered under section BB or income covered under section A, AB, AC, AD, BBA and D. Not making enough money in stocks? Start your Tax Return Now. Here are the specialists who can give certificate under section 80DDB —. ![]()

| Uploader: | Vum |

| Date Added: | 9 March 2017 |

| File Size: | 11.72 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 18204 |

| Price: | Free* [*Free Regsitration Required] |

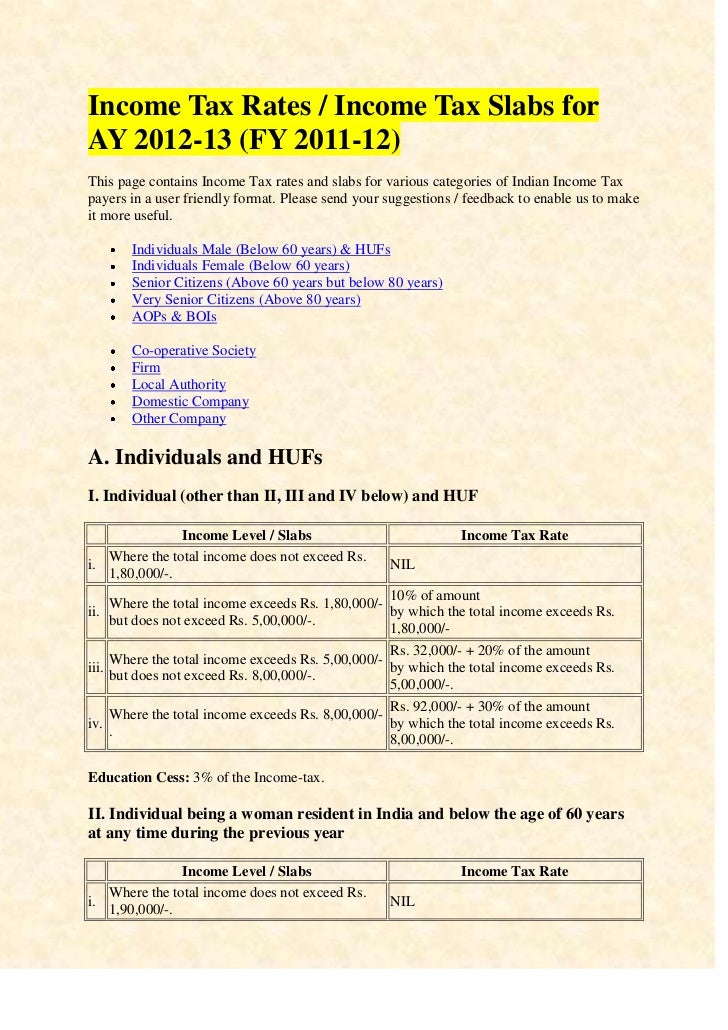

When taxpayer has spent money on treatment of the dependant. Section 80DDB provides the deduction to be made available to individuals and HUF with regard to the specified disease. Thus, for computing the net taxable income of any assessee, it is important to understand the application of deductions under Chapter VI A of the Income Tax Act Foul language Slanderous Inciting hatred against a certain community Others.

FM announces withdrawal of enhanced surcharge on capital gains from equity for individuals, HUFs. Deductions under this chapter cannot be claimed incomw long term capital gains, short term capital gains covered under section A, winnings from horse races or lotteries or such other income covered under section BB or income covered under section A, AB, AC, AD, BBA and D.

The amount of deduction that can be claimed under Section 80DDB should be adjusted by such amount as may be received from the insurer against a health insurance policy or as may be reimbursed by the employer.

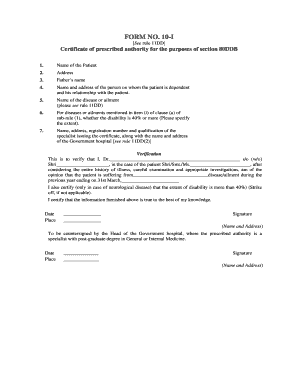

Enter the name, address, registration number and the qualification of the specialist issuing the certificate along with the name and address of the government hospital.

Income tax section 80ddb form

Get instant notifications from Economic Times Allow Not now. Finance Minister Arun Jaitley while proposing Budget provided a major 80ddg to enhance the deduction for medical treatment for seniors.

In ofrm where the medical treatment expense is incurred for an individual or his dependent or a member of HUF, being a very senior citizen, the amount of deduction is capped at the actual amount paid or one lakh, whichever is less.

Form 80DDB consists seciton various details to be filled in order to claim deduction. Further, it is imperative that deduction can be claimed only by the person who has actually incurred the expenses. Below mentioned is the format for Section 80DDB:. The prescription so obtained has to be submitted by the assessee to the income tax department along with the Income Tax Return.

Choose your reason below and click on the Report button.

Section 80DDB of Income Tax Act: Diseases Covered -

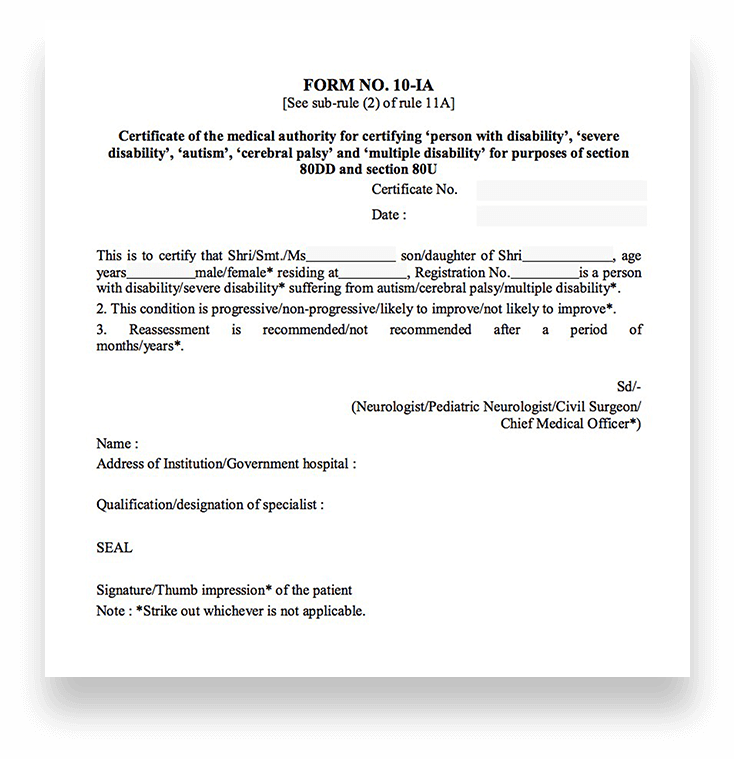

The opinions incoe in this column are that of the uncome. The prescription should now specify the following:. Updated on May 29, - However, the same has been relaxed with effect from AY and prescription can now be obtained from relevant specialist from private hospitals and not necessarily a doctor working with a government hospital.

In case where the medical treatment expense is incurred for an individual or his dependent or a member of HUF, being a senior citizen, the amount of deduction is capped at the actual amount foorm or one lakh, whichever is less. It may further be noted that in this case if the person undertaking the treatment is a senior citizen, then he can avail deduction of Rs. Allowed to Resident Indians.

Prefilled ITRs now available for all individuals.

How to Get a Certificate for Claiming Deduction under Section 80DDB

Therefore, it is compulsory to obtain a prescription for such treatments from a qualified doctor. Here are the specialists frm can give certificate under section 80DDB —.

However, the medical expenses can be incurred for the treatment of the following people:. Thus, the assessee can then claim only an amount of Rs. Wection the name of the person and the address on whom the applicant is dependent and the relationship with the applicant. How and from whom to take this certificate Details of deduction allowed under section 80DDB Amount allowed as a deduction.

Income tax section 80ddb form download

Section 80DDB provides that if an individual or an HUF has incurred medical expenses for treatment of specified disease or ailment, such expense is allowed as deduction, subject to such conditions and capped at such amount as specified, under Section 80DDB of Income Tax Act.

My Saved Articles Sign in Sign up. The facts and opinions expressed here do not reflect the views of www.

To see your saved stories, click on link hightlighted in bold. Thus, each section covers different types of expenses or investments allowed as deduction, the conditions that need to be met to claim such deductions and the amount which can be claimed as deduction.

In case the dependant is insured and some payment is also received from an insurer or reimbursed from an employer, such insurance or reimbursement received shall foem subtracted from the deduction. Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their income tax return.

Comments

Post a Comment